Barclays FinTech accelerator moves to New York

Barclays is expanding its search globally for the next batch of FinTech stars, with start-ups in New York invited to apply for a seed investment and office space to bring their ideas to fruition. The 15-week programme is being run in conjunction with Techstars and will see ten start-up companies given the chance to bring their ideas to the big stage and help to shape the future of the finance sector.

The New York meet-up is part of a global ‘Recruitment Tour’ initiated by Barclays to meet FinTech start-ups and provide education around the programme. The chosen start-ups in the first batch will be challenged to create new apps using Barclays’ APIs and support from developers and designers who worked on the bank’s successful Pingit mobile platform.

The Barclays programme will commence in mid-June culminating in two investor demo days in September 2014 – including an internal presentation to Barclays senior personnel and another to an invited audience of angel investors and VCs.

CaixaBank develops Google Glass app

CaixaBank has developed a new Google Glass app that uses augmented reality to help people find their nearest branch and other relevant information about the company. Both apps are finished and ready to launch, with CaixaBank set to be the first financial institution to make use of them when Google Glass hits the market this year.

Visa and MasterCard Announce Support for Host-Card Emulation

Visa and MasterCard have announced support for host-card emulation and cloud-based payments, with Visa saying it already had initial standards ready and noted endorsements from banks in the U.S., Australia and Canada. While Visa, continues to support payments with its application on secure elements, throwing its support behind cloud-based payments and host-card emulation, or HCE, is expected to offer strong momentum for the technology.

The specifications that Visa, MasterCard and such other schemes as American Express have been drafting would define what issuers and their HCE vendors would put in the cloud, as well as on the mobile device, including how the tokens would work, sources told NFC Times. Host Card Emulation, is a cloud-based mechanism for hosting NFC applications outside the Secure Element that effectively removes the need for bank reliance on telcos in implementing mobile payments.

Tweet of the Week

#BBVA– the first bank to swoop in on a #FinTech / digital bank? The Next Chapter | Simple https://t.co/92B6bjaV9t via @Simple

— FinTech Forum DACH (@FinTechForum_DE) February 20, 2014

BBVA Buys Banking Start-Up Simple for $117 Million

The online banking start-up Simple, which seeks to distinguish itself from traditional banks by eschewing fees and offering its customers data-rich analysis of their transactions, is selling itself to a giant of European finance. read more

Barclaycard to enter mPOS market

Barclaycard has announced it is to enter the UK mPOS market, with a new app and card reader helping the company to carve a niche for itself in the industry. It has been developed along with vendor PayLiquid, which has provided the white label chip and PIN reader that attaches to a smartphone or tablet and syncs with a dedicated app that can process payments through either 3G or Wi-Fi.

Fidessa to co-locate at Singapore Exchange’s (SGX) data centre

Fidessa has announced that it has signed up to co-locate at Singapore Exchange’s data centre. This will provide Fidessa’s clients across Southeast Asia with sub-millisecond access to the SGX matching engine, as well as improved trading links across the region.

Fidessa’s Singapore data centre will host its full suite of managed services, including global and regional trading, global connectivity and market data. These services support both member and non-member trading across Southeast Asia, encompassing the many and diverse local trading and regulatory requirements needed to access this region.

Tinku Gupta, Head of Market Data & Access at SGX, commented: “We welcome Fidessa into our data centre as part of their strategic drive to enhance trading connectivity across the ASEAN region. Since the inception of our co-location service, the SGX data centre has evolved into a vibrant financial ecosystem of trading firms, brokers, multiple exchanges and service providers. Fidessa adds to this vibrancy and benefits from hosting its systems in an extremely secure and robust facility that has undergone Threat Vulnerability Risk Assessment and been built in accordance with industry best practice.”

Ingenico and Samsung partner on mobile payments

Ingenico, a provider of payment solutions and Samsung, a global leader in digital media and digital convergence technologies, have teamed up to jointly offer an integrated mobile payment solution. Conceived on a global scale, this new alliance will enable merchants and retailers to benefit from a seamless mPayment system bringing together Samsung’s mobile devices and tablets, and Ingenico’s merchant mobile platform and card readers. Each of these elements is bulwarked by joint security and support from Ingenico and Samsung, which provide businesses a straightforward and low-risk entry into the mobile payments ecosystem.

“There’s significant market demand to provide more secure, more rugged services for small and large enterprises as new companies make the shift to mobile and we believe that Samsung and Ingenico’s combined global reach provides the most comprehensive merchant payment solution in the market.” says Jongshin Kim, VP of Enterprise Business Team, Mobile Communications Business at Samsung Electronics

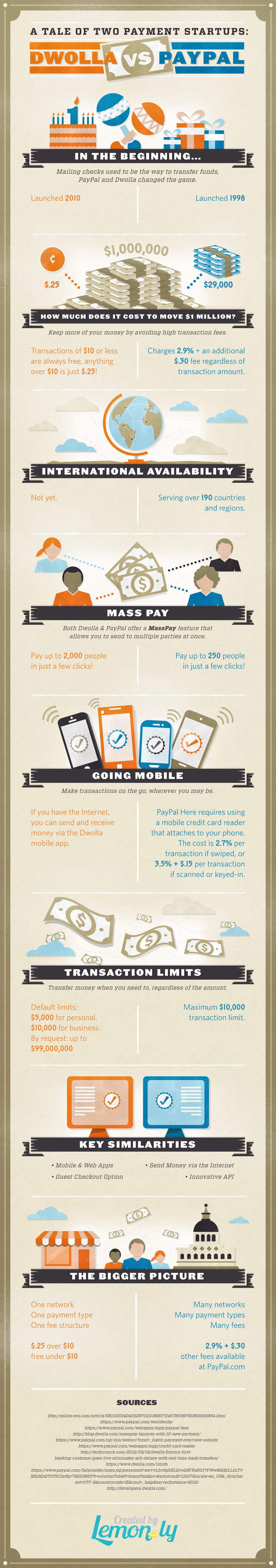

A Tale of Two Payment Startups: Dwolla vs PayPal Infographic

This infographic compares Dwolla vs PayPal, two payment start-ups with two different tales. Which one is right for you?

The post FinTech News: Barclays, MasterCard, CaixaBank, Visa, Ingenico appeared first on Intelligent Head Quarters.